e-Dönüşüm Çözümleri

e-Dönüşüm Çözümleri

e-Fatura, e-Arşiv, e-İrsaliye, e-Defter, e-Defter Saklama ve e-Müstahsil hizmetleri konusunda, 29 yıllık tecrübemiz ile müşterilerimize özel danışmalık hizmeti vermekteyiz. e-Dönüşüm süreci oldukça ciddi bir konudur, anında ulaşılabilir ve yayın bir hizmet ağına sahip olmayı gerektirir. 81 ildeki çözüm ortağımız ile e-Dönüşüm sürecinde firmaların yanındayız

Türkiye’de 397 sıra no.lu VUK tebliğine ile hayata geçirilen ve 5 Mart 2010 tarihinden itibaren uygulamada olan e-Fatura, veri format ve standardı Gelir İdaresi Başkanlığı tarafından belirlenen, VUK gereği bir faturada yer alması gereken bilgilerin içerisinde yer aldığı, satıcı ve alıcı arasındaki iletiminin merkezi bir platform (GİB) üzerinden gerçekleştirildiği elektronik bir belgedir.

Diğer bir tanımla elektronik faturalama olarak da ifade edebileceğimiz e-Fatura, tanımlanan standart kâğıt fatura ile tamamen aynı hukuki niteliklere sahip olan, oluşturma, gönderme, saklama ve ibraz gibi adımların tamamının elektronik ortamda gerçekleştirildiği faturalama şeklidir.

Bünyemizde sunduğumuz çözümler ile KOBİ’leri dijital dünyaya hazırlıyor ve bu süreçte Kurumsal Kaynak Planlaması (ERP) çözümlerimiz ile birlikte, e-dönüşüm süreçlerinde de yanlarında yer alarak maliyetlerinde azalma ve üretkenlik gibi çıktılar almalarını sağlıyoruz.

e-Fatura

Elektronik faturalama olarak da ifade edebileceğimiz e-Fatura, tanımlanan standart kâğıt fatura ile tamamen aynı hukuki niteliklere sahip olan, oluşturma, gönderme, saklama ve ibraz gibi adımların tamamının elektronik ortamda gerçekleştirildiği faturalama şeklidir.

e-Arşiv

Vergi Usul Kanunu hükümlerine göre fatura, kâğıt ortamında en az iki nüsha olarak düzenlenerek ilk nüshası (aslı) müşteriye verilen, ikinci nüshası ise yine kâğıt ortamında aynı kanunun muhafaza ve ibraz hükümlerine göre mükelleflerce saklanılan bir belgedir. 397 sıra numaralı Vergi Usul Kanunu Genel Tebliği ile getirilen e-Fatura Uygulamasına kayıtlı olmayan vergi mükelleflerine 433 sıra numaralı Vergi Usul Kanunu Genel Tebliğinde yer alan şartlara uygun olarak e-Arşiv Uygulaması kapsamında fatura oluşturmaya, kâğıt ortamında göndermeye ve oluşturulan faturaların ikinci nüshasını elektronik ortamda muhafaza ve istendiğinde ibraz edilmesine imkan sağlayan uygulamadır.

e-İrsaliye

487 Sıra No.lu Vergi Usul Kanunu Genel Tebliği ile yürürlüğe giren e-İrsaliye Uygulaması, yaygın olarak kullanılan belgelerden biri olan irsaliyenin Gelir İdaresi Başkanlığı tarafından belirlenen standartlara uygun olarak elektronik belge olarak düzenlenmesi, elektronik ortamda iletilmesi, muhafaza ve ibraz edilmesini kapsayan uygulamadır.

e-Defter

Şekil hükümlerinden bağımsız olarak Vergi Usul Kanununa ve/veya Türk Ticaret Kanununa göre tutulması zorunlu olan defterlerde yer alması gereken bilgileri kapsayan elektronik kayıtlar bütünüdür.

e-Müstahsil

e-Müstahsil Makbuzu, tarımsal ve hayvansal ürünlerin satın alınmasında fatura yerine geçen ticari bir vesika olarak kullanılmakta olan müstahsil makbuzu ile aynı hukuki değerlere sahip olan elektronik belgedir. Müstahsil Makbuzu düzenleyen mükellefler, kağıt ve e-müstahsil olarak muhafaza edip Gelir İdaresi Başkanlığına raporlayabilmektedirler.

e-Adisyon

e-adisyon Geleneksel kağıt fişlerin yerini alarak restoranlar, kafeler ve diğer yiyecek-içecek işletmelerinde dijital olarak siparişlerin alınıp yönetilmesini sağlayan bir sistemdir. Wolvox Restoran e-adisyon sistemi, hem müşteri memnuniyetini artırmak hem de işletme verimliliğini artırmak amacıyla kullanılır.

e-Mutabakat

Zaman kazanmanızı sağlayan hızlı ve güvenilir bir yöntem olan e-Mutabakat, kağıt üzerinde hazırlanan ve çıktısı alınarak posta veya faksla gönderilmeye çalışılan mutabakat mektuplarının e-posta veya sms ile müşterilere ulaştırıldığı güvenilir bir sistemdir. Sistemin gönderi hızı ve güvenliği yanında gelen cevap ve geri dönüşleri takip etme bakımından da çok avantajlıdır.

Mutabakat formlarını toplu bir şekilde müşterilerinize gönderebilir, mutabakat mektuplarının ulaşma, okunma vb durumlarını da takip edebilirsiniz. e-Mutabakat ile mutabakat formlarının takibini kolaylaştırarak müşteri ilişkilerinizi düzenli hale getirebilirsiniz.

BA-BS formları Maliye Bakanlığına bağlı Gelir İdaresi Başkanlığının önemli araçlarından biridir.

BA kısaltması (Bildirim Alacak); Mal ve hizmet alımlarına ilişkin bildirim için kullanılır.

BS kısaltması (Bildirim Satacak); Mal ve hizmet satışlarına ilişkin bildirim için kullanılır.

Günümüz teknolojisinde artık hayatın her aşaması dijital olmaya başladı. Biz de AKINSOFT olarak yazılımlarımızı dijital ortamlara taşıyarak e-hallerini müşterilerimizle buluşturuyoruz. E-Defter, e-fatura, e-arşiv ve e-mutabakat WOLVOX ERP yazılımımızla entegre sunduğumuz e-çözümlerimiz.

TC. Maliye Bakanlığı Elektronik Defter tebliğine istinaden e-defter kayıtları.

WOLVOX Genel Muhasebe Programı ile e-defter programı entegrasyonu.

E-Defter kayıtlarını mali dönemlere göre oluşturma.

Defter oluşturulup Elektronik İmza ya da Mali mühür ile onaylanması.

Zaman damgası ile defterin ne zaman oluşturulduğunun görüntülenmesi.

Oluşturulan defterlerin, GİB’e iletilen ya da GİB’den alınan beratların durumları takibi.

Berat dosyalarının yıl, ay ve şirket dizinleri içerisinde kayıt edilmesi.

E-Defter saklama hizmeti programı aracılığı ile beratların yedeklenmesi.

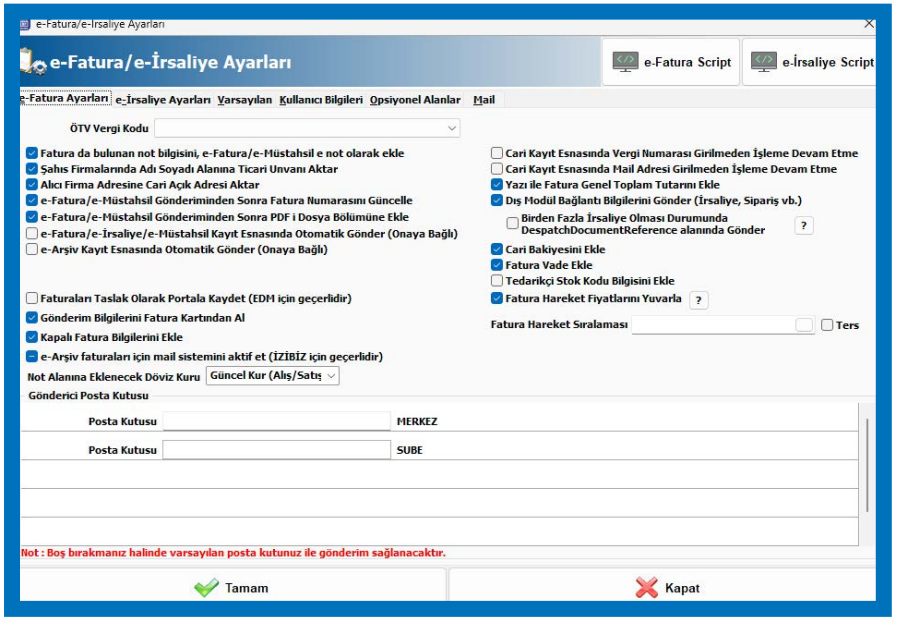

WOLVOX ERP kullanıcıları için E-Fatura,E-Arşiv,E-İrsaliye, e-Müstahsil entegrasyonu.

Wolvox ERP ile e-Mutabakat sistemini kullanabilme.

e-Mutabakat sistemi ile BA / BS formu veya cari hareketlerini mutabakat formuna dönüştürerek e-posta aracılığı ile carilere ulaştırabilme ve verdikleri cevapları görüntüleyebilme.